Life Insurance Education for Clients

7 min read

7 min read

Most Americans don’t have enough life insurance coverage. Many don’t have any at all. In total, it’s estimated that more than 100 million Americans are either underinsured or completely uninsured.1 Competing financial priorities, misconceptions about the costs and not understanding how life insurance works are all contributing factors. Educating your clients on the benefits of life insurance is crucial to help them get the coverage they need.

The 2023 Insurance Barometer Study by LIMRA outlines current reasons why people don’t buy life insurance. This article explains how life insurance education can help overcome their objections.

Do it for your family and home

Protecting the home and family are often the key drivers behind a life insurance purchase. It supplies financial protection for surviving loved ones. This could mean making sure your client has enough coverage to cover household needs or to pay off their mortgage. If the deceased parent’s income was also the funding source for college saving, replacing this should be considered, as well. Even a parent who’s not the family breadwinner should consider life insurance. Replacing the care a stay-at-home parent provides can be expensive. Life insurance can be a source of these funds if the unexpected happens.

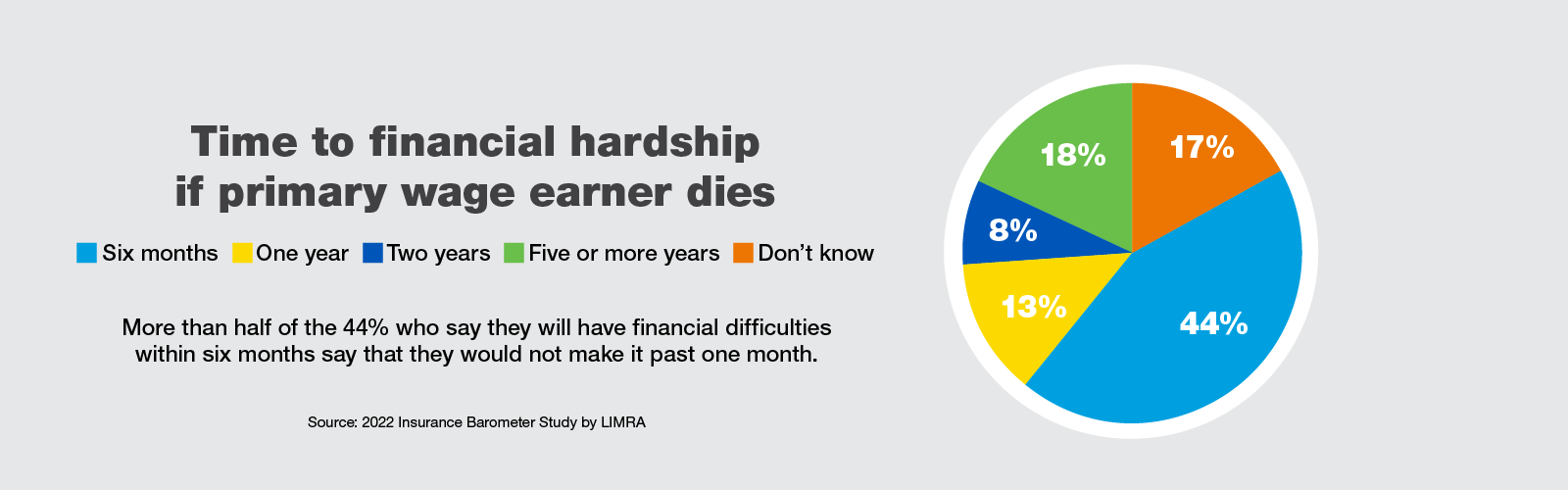

Have your client consider if their loved ones are prepared to financially survive the death of a primary wage earner. 10% of people surveyed in the 2023 Insurance Barometer Study would feel the impact within one week. 44% reported it would be within six months.1

Your work coverage is probably not enough

Group life insurance that’s offered through an employer is a convenient way to get important coverage. For many, it’s the first step in protecting loved ones from the unexpected. However, employees can’t always select the level of coverage with a group policy. Coverage offered by an employer is, on average, either a flat sum of $20,000 or one year’s salary.1 Your client may think it sounds like a lot of money. Helping them figure out what life insurance proceeds need to cover helps them realize protection for a year’s worth of replaced income probably isn’t enough.

If there is a coverage gap, then you may need to suggest supplementing their group insurance with an individual policy. A common rule of thumb is that life insurance should supply seven to 10 times the insured person’s annual salary. That’s just a starting point. Help your clients look at a variety of factors, including income, assets, liabilities and future plans, such as having more children or retiring.

In general, consumers who have individual life insurance and workplace coverage tend to have more financial security. They usually have higher levels of coverage and are less vulnerable to losing coverage due to a change in employment status.

You need it because you have plenty of assets to leave loved ones

Your client may not be concerned about their loved ones’ finances if they were to pass away, simply because they already have enough assets to support them. At this point, explain to them that if the assets are mostly in non-liquid form, such as real estate, a share in a business, or even jewelry, a life insurance policy could supply cash to pay off debts requiring immediate attention. Even without estate taxes, an estate can face many costs after a death. End-of-life medical expenses. Funeral costs. Credit card and other debt. Attorney’s fees and court costs. With smaller estates, these costs make up a larger percentage of the total estate. Without a liquid asset to supply cash to settle the estate, non-liquid assets often need to be sold quickly and not at their full value.

Significant wealth does not mean sufficient estate liquidity. Planning for enough cash to pay estate expenses and creditors allows the executor the necessary time to deal with more difficult assets like real estate. Life insurance is a simple strategy for a liquidity problem and can accomplish many of your client’s other planning goals as well.

Life insurance can help you meet other financial goals

34% of Americans have not bought life insurance because they “don’t like thinking about death.”1 Don’t underestimate how deeply such feelings affect your clients. Discussing how the benefits of life insurance can help them achieve other financial goals helps build trust. Your clients become more comfortable talking about financial security as a broad topic with end-of-life planning as just another scenario. Other goals that individuals use life insurance for are:

- Paying estate taxes or creating estate liquidity.

- Saving in a tax-advantaged way.

- Supplying funds for a college education.

- Making a charitable gift.

- Funding business planning objectives.

Coverage isn’t as expensive as you think

64% of people who haven’t bought life insurance say it’s because they thought it was too expensive. But people tend to overestimate the cost of insurance. When asked how much a term life policy would cost for a healthy 30-year-old, almost 50% said at least $500 annually. Nearly one in four people said at least $1,000 per year. However, the industry average annual cost is only $160. Overall, the cost of life insurance is overestimated by as much as 300%.1

Overcoming this objection may be as simple as figuring out the needed coverage and running an illustration. In fact, premiums for life insurance are typically lower than other forms of insurance and are often less expensive than buying a daily cup of coffee.

People often realize they need life insurance, but it’s not a priority for them. 60% of millennials consider their cellphone, internet and cable payments higher priorities than buying life insurance. 49% of those 65 and older say the same thing.1 One way to make it more of a priority is to reinforce just how inexpensive life insurance can be.

If you wait, it will cost you

35% of households haven’t bought life insurance simply because they hadn’t gotten around to it yet.1 But, with everything else that’s competing for our time and attention, it can be hard to follow through with an actual insurance purchase.

Remind your clients of this basic life insurance education: the longer they wait, the more they’ll spend. The older they are, the more expensive the premiums. And it is unlikely that a person would be healthier at age 40, 50 or 60 than they were at age 30. When they’re at their strongest and healthiest is the time to get a policy to protect their loved ones. If they fall seriously ill or suffer significant injury later, it will make it tougher to get a policy, if they can at all.

I can guide you through the process

One of the main reasons people don’t buy life insurance is that they’re confused by all the varieties and options that are available. In fact, 40% say they don’t know how much insurance they need or even what type to buy.1 This is a good opportunity for financial professionals to help. Three in four people say they would prefer to meet with a financial professional so they can ask questions and receive immediate help.1 You can help them realize that life insurance doesn’t have to be as complicated as they might think.

Life insurance education for your clients is an important way to overcome common objections to buying it. Helping them understand the benefits of life insurance can go a long way to help them feel comfortable with the purchase.

Sources and References:

1LIMRA 2023 Insurance Barometer Study

Interested in representing Ameritas?

Discover the advantages we offer industry professionals of all kinds.