In changing economic times, everyone likes a little security—especially if you’re concerned about preserving your assets.

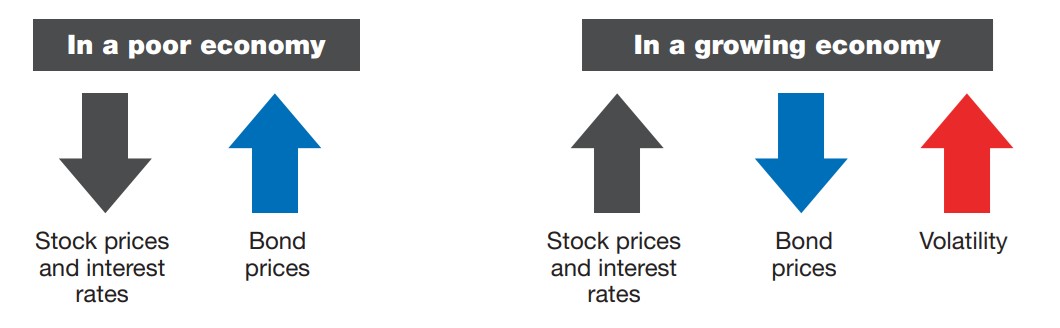

The ups and downs of the market can be hard to handle. In the past, a well-balanced portfolio of stocks and bonds has been the way to manage market volatility. The inverse nature of stocks and bonds helps balance the ups and downs. When stocks go down, bonds go up and vice versa. This happens because stocks are tied to market performance and bonds are tied to interest rates.

A poor economy generally sends stock prices and interest rates lower. Lower interest rates mean bond prices go up. However, when the economy is doing well, interest rates rise, and bond prices fall. Rising rates lead to lower bond prices and generally increase stock market volatility. This causes uncertainty in reaching financial goals and leaves many wondering how to deal with market volatility.

Let’s look at a hypothetical example. Joe is 60 and in good health. He saved about $3 million over his career. The majority is in his 401(k), which enjoys tax-deferred growth. He also has a tax-free Roth IRA and some non-qualified mutual funds and CDs. He is five years from retirement and is confident that he’ll have enough money to support his standard of living. He’s more concerned about leaving as much as he can to his children. He wants his assets to grow in value, not be hit hard by drops in the market.

Joe makes an appointment with Carl, his financial professional, to find out a way to answer his questions about how to deal with volatility.

Life insurance can help stabilize your investment portfolio

Carl recommends Joe buy a universal life insurance policy. It provides money, called a death benefit, that’s paid to the beneficiary of the policy. This death benefit is not linked to market performance. That means the market could be down 50% and it wouldn’t matter. Knowing the guaranteed* death benefit amount from life insurance may allow for more flexibility. You may be willing to invest other assets more aggressively because of the certainty that the policy’s death benefit adds to your overall portfolio.

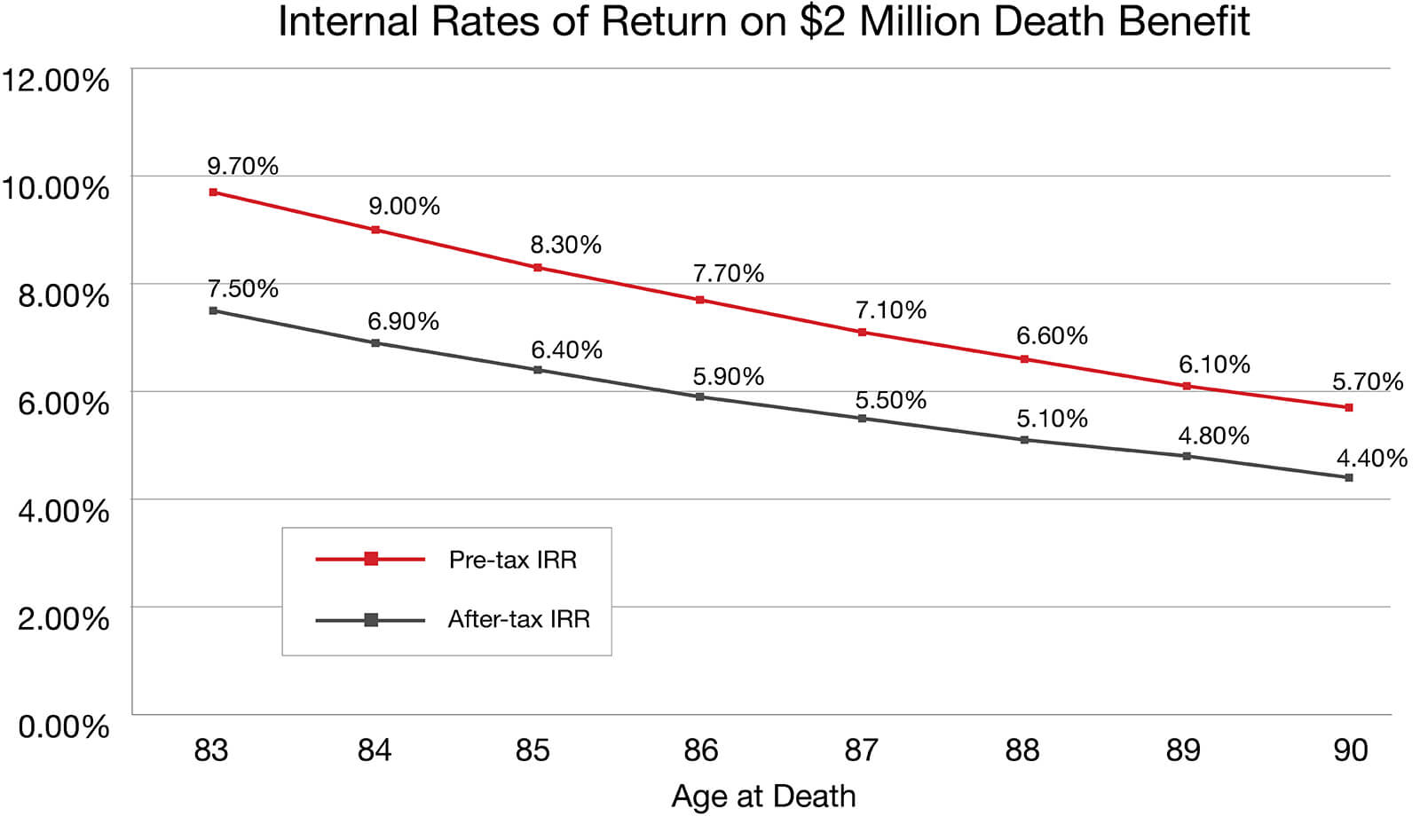

Early in the life of the policy, life insurance can turn a limited number of premium payments into a sizeable death benefit. That’s because it earns a competitive internal rate of return (the rate of return that the premiums paid would have to earn to equal the death benefit.) Even in later years, the internal rate of return is still competitive.

For example, look at the $2 million life insurance policy that Joe purchases. He pays an annual premium of $30,000. If he were to pass away at age 83, the life expectancy for a 60-year-old male,1 his policy would have earned an internal rate of return of almost 8%. Assuming he pays a 24% tax rate, the pre-tax equivalent is almost 10%.

Universal life insurance is designed to take advantage of rising interest rates

A universal life insurance policy builds cash value. This cash value grows as premiums are paid and interest is credited. The interest rate the cash value earns typically fluctuates with current market rates—increasing and decreasing along with the market. However, there is typically a minimum guaranteed interest rate that the policyholder receives.

When interest rates rise, your policy’s cash value grows faster. It also provides tax-deferred growth. You can take a loan out against the policy’s cash value when you need help with extra funds, say for a child’s college tuition, money in retirement or an emergency. You won’t have to pay taxes on the loan as long as your policy stays in force.2

While Joe doesn’t foresee having any situations where he would need extra money during his retirement, he likes the idea of building cash value within the policy that he can access if he needs it. More importantly, he likes the accelerated death benefit rider that is automatically included on his policy at no extra cost to him. He hadn’t planned for the possibility of experiencing a serious medical condition. Now, if he does, he can access a part of the death benefit to help pay for his care, preserving his other assets.

Permanent life insurance helps stabilize your investment portfolio by providing the potential for growth and protection regardless of what’s happening in the market. This enables you to:

- Leave a legacy to the ones you love.

- Create financial protection for your family.

- Build cash value for future needs.

Ameritas can help

Markets are unpredictable, and volatility can have a significant impact on the amount of money you leave to your loved ones. Life insurance can help. Learn more about Ameritas offerings for life insurance.

Contact a financial professional to learn more about how to deal with volatility.

Need help with your financial goals?

While you can learn more about our products on this website, this information is no substitute for the guidance of a qualified professional. If you’re serious about assessing your financial wellness, contact a financial professional.

Do you already have an agent?

Sources and References:

*Guarantees are based on the claims paying ability of the issuing company.

1US Census Bureau

2Tax law permits a policy owner to withdraw life insurance policy cash values up to the policy owner’s basis or investment in the contract without income tax consequences. Withdrawals and loans will reduce the available death benefit. Withdrawals beyond basis may be taxable income. Excess and unpaid loans will reduce policy value and may cause the policy to lapse. If a policy lapses, unpaid loans are treated as distributions for tax purposes. For more information about the tax results of life insurance, consult your attorney or tax advisor.