Customized Retirement Solutions

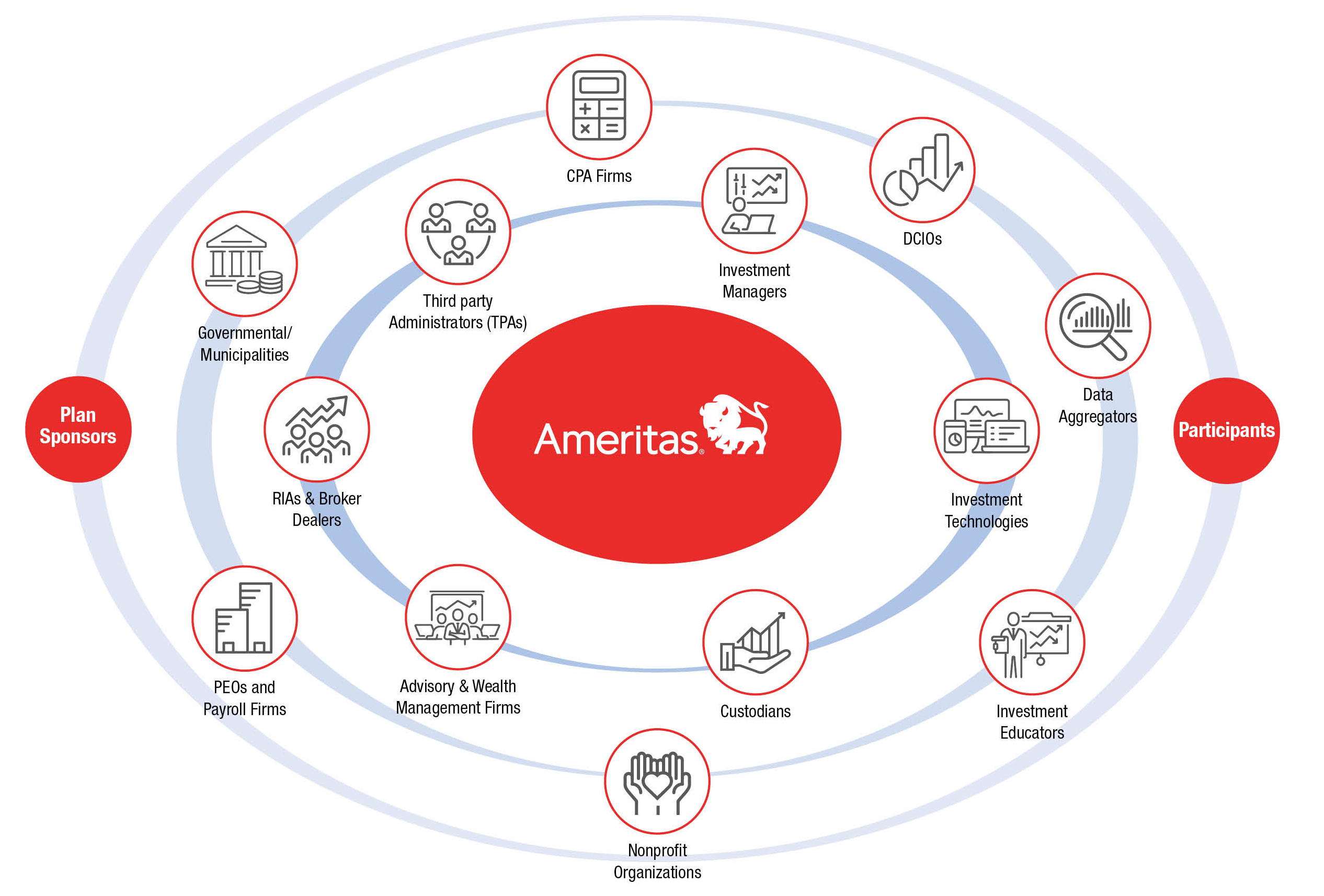

Ameritas offers customized retirement solutions through a broad network of financial intermediaries to help your business thrive.

Ameritas can serve in a bundled or unbundled relationship, either as the recordkeeper or the recordkeeper and TPA. We can bring in any of these relationships to the plan:

Think we might be a good fit for your clients?

Our retirement team is committed to helping build your retirement business.

Two competitive solutions

EliteUnlimited

EliteAdvantage

Customizable administrative services to fit your client’s needs

All the rules and regulations about retirement plans can be overwhelming. We offer options for managing the day-to-day aspects of plan administration and keeping the plan in compliance.

Unbundled model

Ameritas has processes in place to seamlessly interface with TPAs who can provide plan design and document services while Ameritas supplies recordkeeping services.

Bundled model

The plan sponsor can contract with Ameritas to supply all aspects of plan servicing including plan documents, compliance and recordkeeping.

Our open architecture solution offers an optional 3(16) service, which provides full administration of the plan. These functions include distributing summary plan descriptions, soliciting and enrolling members, and fulfilling reporting requirements.

Fiduciary services for selecting investment options

Both our open architecture and traditional, commission-based solutions offer a robust investment platform. You’re free to select the investments that are right for your client. We have teamed up with industry experts to provide optional fiduciary services to help:

3(21) service

A flexible approach to provide fiduciary coverage for investment selection and monitoring. They recommend investment options, and you work with your client to make the final decision.

3(38) service

A “do it for me” approach for investment selection and monitoring. They assume full discretion for selecting and monitoring investment options.

Think we might be a good fit for your clients?

Let’s continue the conversation.